ABSTRACT

Ethical decision-making by tax consultants in Indonesia faces significant challenges due to rising cases of unethical practices, such as bribery and fraudulent tax reporting. These issues undermine public trust and compliance with tax regulations, highlighting the urgent need to examine factors influencing ethical judgments in this profession. This study investigates how Professional Ethics, Tax Consultant Competency, and Machiavellianism affect Ethical Decision-Making, with Locus of Control as a moderating variable. This study aims to provide empirical evidence to strengthen ethical standards in Indonesia’s tax consulting sector. A quantitative associative approach was employed, using data from 301 certified tax consultants registered with the Indonesian Tax Consultants Association in Banten, and data were collected via questionnaires and analyzed using Partial Least Squares (PLS) with SmartPLS software. The study show that Professional Ethics significantly affects Ethical Decision-Making, Tax Consultant Competence significantly affects Ethical Decision-Making, Machiavellianism significantly affects Ethical Decision-Making. Locus of Control moderates the relationship between Professional Ethics and Ethical Decision-Making, Locus of Control does not moderate Tax Consultant Competence on Ethical Decision-Making, and Locus of Control does not moderate the Machiavellianism on Ethical Decision-Making. Strengthening professional ethics and competency through training, coupled with measures to mitigate Machiavellian traits (e.g., integrity cultures and supervision), is critical for improving ethical decision-making. Future research should explore alternative moderators beyond locus of control.

INTRODUCTION

Tax consultants play a crucial role in assisting taxpayers in fulfilling their tax obligations and exercising their rights in accordance with applicable tax regulations. They are instrumental in raising awareness, providing education, and offering guidance to taxpayers regarding tax laws, while also serving as intermediaries between taxpayers and fiscal authorities. In practice, tax consultants often face moral dilemmas as professionals. They aim to minimize tax burdens for their clients, yet they also strive to enhance tax compliance and encourage taxpayers to pay the full amount of taxes owed in line with existing tax regulations. Consequently, tax consultants are frequently requested to revise tax reports, which may lead them to deviate from or make incorrect moral decisions.

For instance, some tax consultants engage in unethical practices, such as bribing tax auditors and staff at the Directorate General of Taxes to manipulate the tax audit process for their clients, involving significant sums of money. Another ethical issue faced by tax consultants when handling client cases is the issuance of fraudulent tax invoices by mining trading companies, resulting in substantial losses to the state (Laluhu, 2020). According to general taxation procedures, a legally appointed tax consultant who engages in such tax-related crimes has committed a criminal offense (Pratama, 2024).

Ethical decision-making by tax consultants is essential to minimize the manipulation of corporate tax reports amid cases of fraudulent practices. Professionals in this field must uphold ethical standards, a sense of responsibility, objectivity, and a commitment to serving the public.

Maharani (2024) found that commitment to professional ethics has a significant negative impact on ethical decision-making, suggesting that tax consultants with lower ethical commitment may paradoxically make better ethical decisions. Additionaly, Sundari et al. (2021) revealed that professional ethics and competence positively and significantly influence ethical decision-making processes.

Christian & Susanto (2021) highlighted that professional ethics, responsibility, Machiavellianism, and ethical considerations positively and significantly affect ethical decision-making. Conversely, Ng et al. (2023) argued that Machiavellianism has a negative impact on ethical decision-making. However, Tofiq & Mulyani (2018) found that Machiavellianism does not negatively influence the ethical decision-making process.

Furthermore, Pratama & Wirama (2018) identified a positive moderating relationship between tax consultants’ ethical decisions and intellectual intelligence. Utama & Jati (2024) discovered that idealism and professional commitment positively influence ethical decision-making among tax consultants, while locus of control showed no significant impact. In contrast, Limajatini et al. (2019) suggested that locus of control can enhance the ethical behavior required of professionals in the financial sector.

According to the Indonesian Association of Tax Consultants (IKPI, 2019), a code of ethics consists of moral principles that guide members in their actions, thoughts, and attitudes, ensuring they perform their duties professionally, objectively, independently, and with high dedication. Bell (1976) defines a profession as an intellectual activity encompassing education, including formal or informal courses and training, certification by a responsible institution or body in a specific field, and adherence to professional ethics, which involves the ability to generate ideas, thoughts, technical skills, and motivation. The IKPI code of ethics outlines four indicators of professional ethics for tax consultants, namely:

- Objectivity

- Integrity

- Public Interest

- Technical Standard

The mastery and skills possessed by an individual in carrying out their professional duties, thereby fostering public trust, are referred to as competence. According to the Center for Financial Profession Development (2024), tax consultants must pass a certification examination conducted by the Indonesian Association of Tax Consultants (IKPI). This enables tax consultants to provide tax system consultation services that align with their competence and expertise, which include:

- USKP Level A

This is a tax consultant competency examination that demonstrates their ability to provide tax services. It applies solely to the rights and obligations of individual taxpayers, except in cases involving consultations with taxpayers residing in countries that have entered into double taxation avoidance agreements with Indonesia.

- USKP Level B

This is a tax consultant competency certification examination that assesses their ability to provide tax consultation services to both individual and corporate taxpayers regarding the fulfillment of their tax rights and obligations. This examination does not apply to individual taxpayers involved in foreign investment, permanent establishments, or those residing in countries with double taxation avoidance agreements with Indonesia.

- USKP Level C

This is a tax consultant competency certification examination that evaluates their ability to provide tax consultation services to both individual and corporate taxpayers in fulfilling their tax rights and obligations.

According to Bhandari et al. (2023), Machiavellianism refers to a level at which an individual becomes pragmatic, emotionally detached, and holds the belief that outcomes take precedence over processes. Machiavellianism focuses on the understanding that a person’s personality exhibits manipulative, cold, and calculative traits. Furthermore, Sabaruddin et al. (2023) describes Machiavellianism as a manipulative personality type, where an individual has specific goals and continuously thinks about and employs various methods to achieve them, without considering the feelings of others involved.

Tax consultants providing taxation services to taxpayers can assure them that the services offered are of high quality, professional, and trustworthy (Jiwo, 2011). According to Tofiq & Mulyani (2018), ethical decision-making involves making choices that align with moral and legal standards acceptable to the general public.

Locus of control refers to an individual’s belief that they have the ability to control events in their lives through internal strengths (Tofiq & Mulyani, 2018). Greenhaus & Callanan (2006) define locus of control as a tendency to perceive events and outcomes in one’s life as resulting either from internal factors within themselves or from external sources, such as luck, fate, or assistance from others. However, Rotter (1966) describes locus of control as a personality variable determined by an individual’s belief in their ability to control the course of their own life.

Hypothesis Development

Professional Ethics on Ethical Decision-Making

A study by Made et al. (2018) found that perceptions of professional ethics have a positive impact on ethical decisions made by tax consultants. Additionally, Sinaga (2022) revealed that the influence of the tax consultant’s code of ethics on their ethical decisions is highly significant. Therefore, the first hypothesis of this study is as follows:

H1: Professional ethics positively influence ethical decision-making.

Tax Consultant Competence on Ethical Decision-Making

Nadilla & Juliardi (2021) conducted research on the impact of ethics, social responsibility, and Machiavellianism on the ethics of tax consultants in decision-making. The study concluded that competence has a significant influence on ethical decision-making. Therefore, the second hypothesis of this study is as follows:

H2: Tax consultant competence positively influences ethical decision-making.

Machiavellianism on Ethical Decision-Making

A study by Christian & Susanto (2021) found that Machiavellian traits influence the way tax consultants make ethical decisions. Similarly, a study by Silitonga & Hidayat (2019) also determined that Machiavellian attributes affect how tax consultants approach ethical decision-making. Therefore, the third hypothesis of this study is as follows:

H3: Machiavellianism has a positive impact on ethical decision-making.

Locus of Control Moderates Professional Ethics on Ethical Decision-Making

A study by Duhita et al. (2022) concluded that locus of control plays a role in moderating the influence of professional ethics on professional performance. Meanwhile, a study by Jazadi (2023) stated that locus of control moderates the positive relationship between professional quality and professional ethics. Therefore, the fourth hypothesis of this study is as follows:

H4: Locus of control moderates the influence of professional ethics on ethical decision-making.

Locus of Control Moderates Tax Consultant Competence on Ethical Decision-Making

Dwipa et al. (2023) recognized that locus of control has a moderating effect on the influence of professional performance on the ethical decisions of tax consultants. Another study by Pratama & Wirama (2018) found that if tax consultants possess an internal locus of control, their ethical decisions, as influenced by intellectual intelligence, tend to be more ethical. Therefore, the fifth hypothesis of this study is as follows:

H5: Locus of control moderates the influence of tax consultant competence on ethical decision-making.

Locus of Control Moderates Machiavellianism on Ethical Decision-Making

A study by Putri (2020) found that locus of control has a positive impact on Machiavellianism in ethical decision-making. Study by Tofiq & Mulyani (2018) determined that locus of control and Machiavellian traits significantly influence how tax consultants make ethical decisions. Additionally, a study by Alvionita & Aufa (2023) revealed that locus of control can mitigate the impact of Machiavellian traits on ethical decision-making. Therefore, the sixth hypothesis of this study is as follows:

H6: Locus of control moderates the influence of Machiavellianism on ethical decision-making.

RESEARCH METHOD

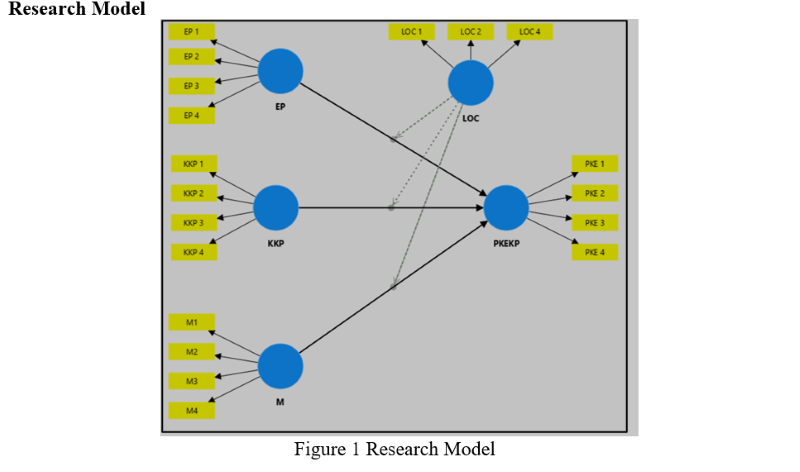

Descriptive research is a type of study that adopts a quantitative approach. The purpose of this research is to test a theory, referred to as a hypothesis, using quantitative data. The researchers analyze how professional ethics, tax consultant competence, Machiavellianism, and locus of control serve as dependent variables, while the ethical decision-making of tax consultants functions as both a moderating variable and an independent variable.

Population and Data Collection

The population studied in this research consists of certified tax consultants at Levels B and C who are registered in the Banten region, encompassing Tangerang Regency, South Tangerang, and Tangerang City, as recorded by the Indonesian Association of Tax Consultants (IKPI) up to 2023. The total population comprises 307 individuals. Data collection was conducted using a questionnaire method, where out of the 307 questionnaires distributed, only 301 were returned and fully completed..

Variable Operationalization

This study includes three types of variables: independent variables, dependent variables, and moderating variables. The dependent variable is Ethical Decision-Making (PKE), while the independent variables consist of Professional Ethics (EP), Tax Consultant Competence (KKP), Machiavellianism (M), and Locus of Control (LoC) as the moderating variable.

Data Analysis

Data processing will be conducted using the Partial Least Squares (PLS) technique. The structural equation model is expressed as follows:

To determine whether the overall model is adequate, testing of the outer model and inner model will be conducted.

RESULT AND DISCUSSION

This descriptive study utilizes primary data. Each participant received a questionnaire, which was then processed using the SmartPLS software, incorporating both the outer model and the inner model.

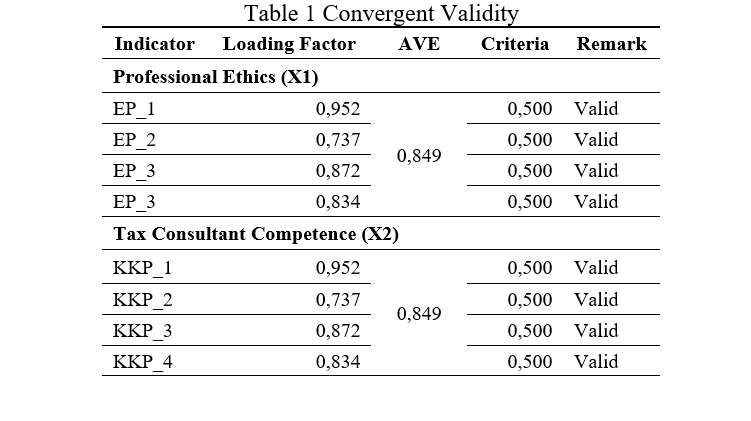

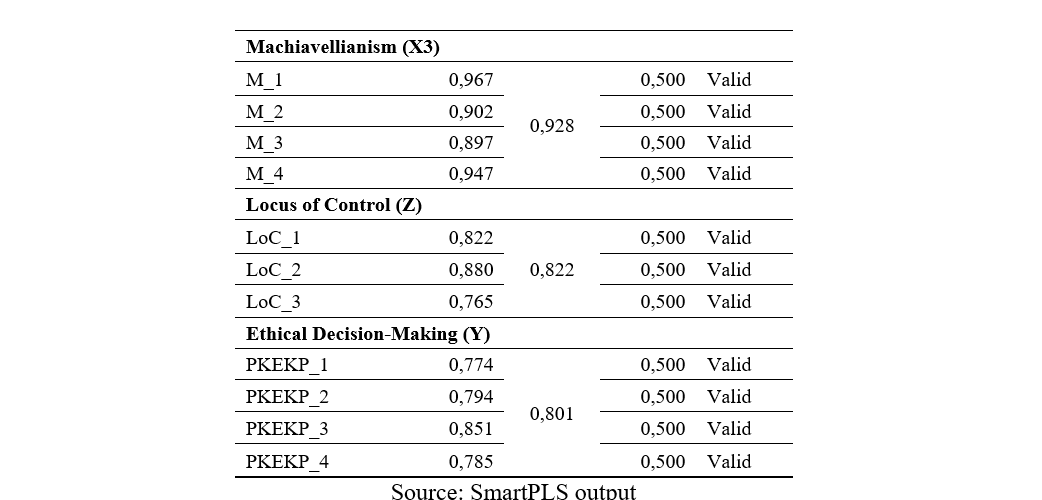

Convergent Validity Test

The convergent validity test is conducted using the outer loading or factor loading values. Each questionnaire item is considered valid if its outer loading value is ≥ 0,7.

All indicators of the research variables are deemed to meet the requirements for the convergent validity test, as shown in Table 1, since the factor loading value of each indicator is ≥ 0,7.

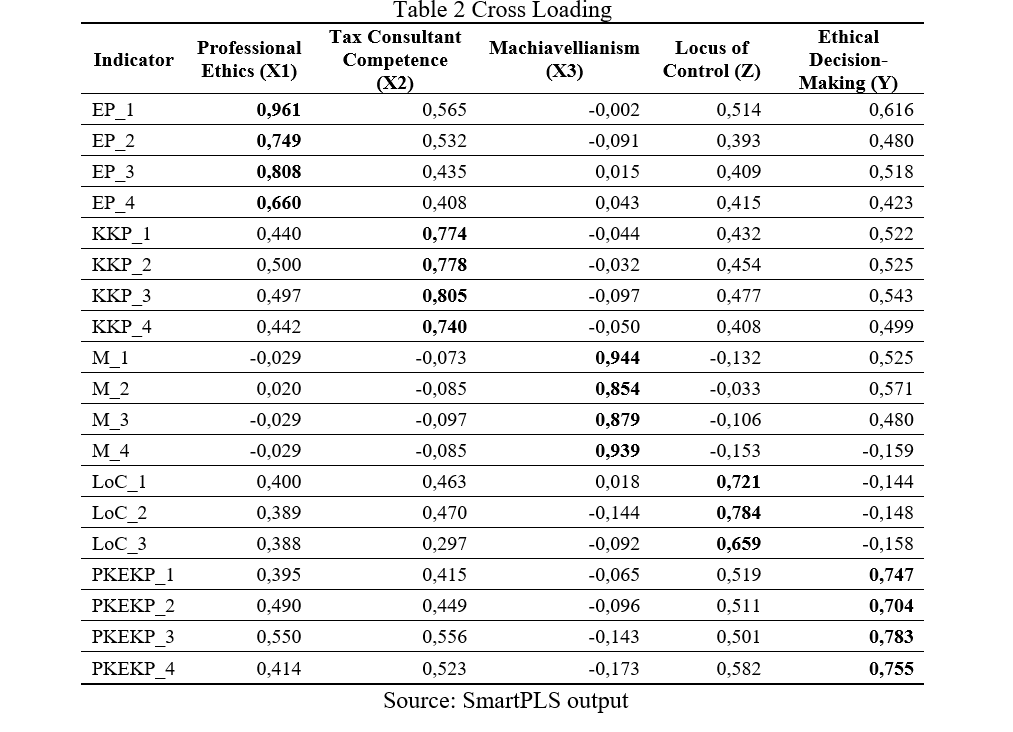

Cross Loading Discriminant

If the cross-loading value of an indicator on its respective variable is the highest compared to other variables, the indicator is considered to meet the cross-loading discriminant criteria.

Based on the cross-loading values of each variable in this study, all indicators demonstrate the highest outer loadings, indicating strong discriminant validity in constructing their respective variables. As shown in Table 2, each indicator has the most significant outer loading value. In other words, all indicators have successfully passed the discriminant validity test.

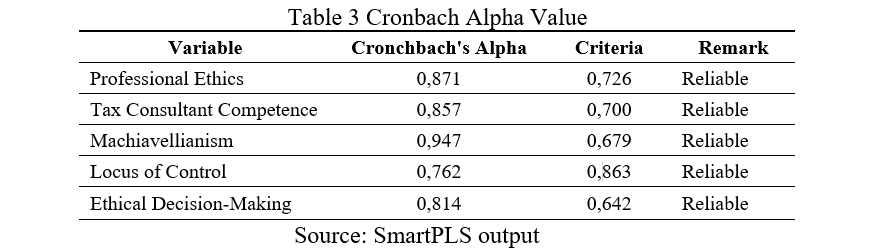

Reliability Test

The Cronbach’s Alpha value is used to assess the reliability of variables. A variable is considered reliable if it has a Cronbach’s Alpha value ≥ 0,7. The Cronbach’s Alpha values for each variable are presented below.

As shown in table 3, all variables in this study exhibit Cronbach’s Alpha values ≥ 0,7 indicating that they meet the reliability criteria.

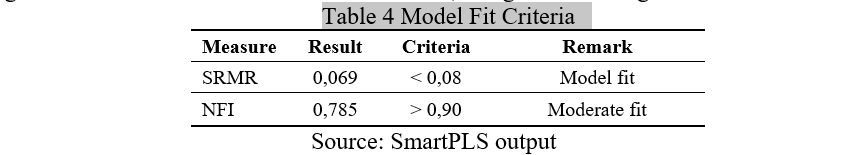

Goodness of Fit Test

Model fit evaluation (also referred to as goodness of fit) was conducted to assess the alignment of the data with the SmartPLS method, using the following measures:

The recorded SRMR value of 0.069, which is below the threshold of 0.08 (see Table 4), indicates an adequate fit between the evaluated data and the predicted model. Meanwhile, the NFI value of 0.785, falling below the standard threshold of 0.90, suggests that the model has not yet achieved an optimal fit. Although the value approaches a moderate fit, it remains insufficient to be classified as a perfect fit.

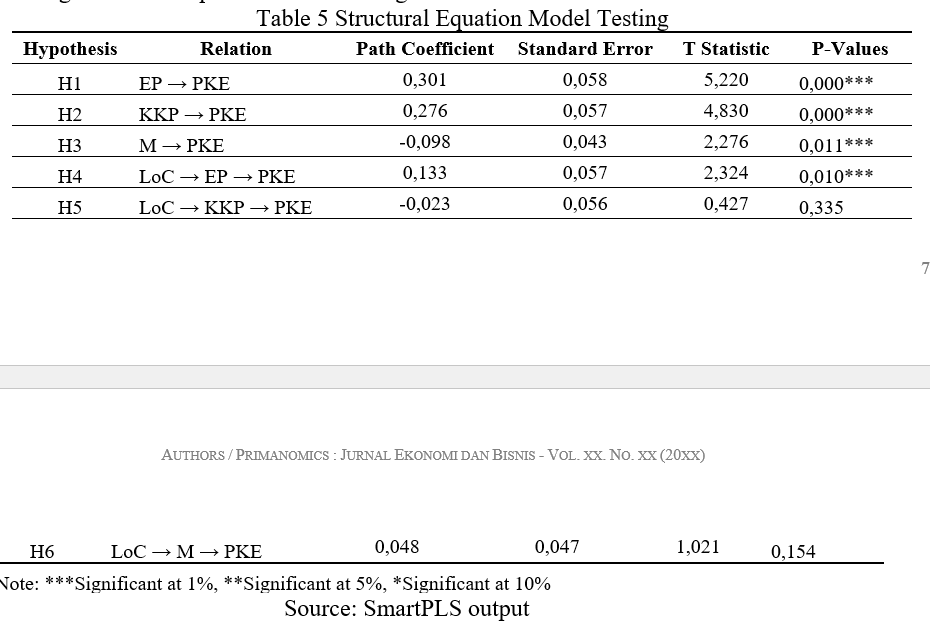

Structural Equation Model Test Results

This section presents the empirical test results for each research question and hypothesis, derived from descriptive and verificative analysis. The obtained data are further compared with existing theories and prior research findings.

Discussion

Professional Ethics on Ethical Decision-Making

Table 5 indicates that professional ethics significantly influence moral decision-making. The emphasis on professional ethics encourages tax consultants to adhere to ethical codes when making moral judgments. Professional ethics serve as a fundamental guideline for tax consultants in ethical decision-making. Compliance with these ethical codes increases the likelihood of making ethically sound decisions. Based on these findings, H1 is supported.

Tax Consultant Competence on Ethical Decision-Making

As presented in Table 5, tax consultant competence positively affects ethical decision-making. High competence reflects a thorough understanding of tax regulations, professional ethical standards, and moral obligations as a tax consultant, enabling them to distinguish between legally compliant and ethically questionable actions. With this knowledge, tax consultants are more inclined to make ethical decisions. Consequently, H2 is supported.

Machiavellianism on Ethical Decision-Making

Table 5 reveals that Machiavellianism influences morally relevant decision-making. A high level of Machiavellianism may lead tax consultants to prioritize personal or client gains over ethical principles, potentially resulting in decisions that deviate from professional and ethical standards. Therefore, it is crucial to recognize how this personality trait impacts professional conduct and to implement measures—such as ethics training, strict supervision, and moral evaluations—to mitigate its negative effects. Based on this analysis, H3 is supported.

Locus of Control Moderates Professional Ethics on Ethical Decision-Making

The results in Table 5 demonstrate that locus of control influences the relationship between professional ethics and moral decision-making. Tax consultants with an internal locus of control, who believe they can determine their own outcomes, tend to be more influenced by their professional ethics. Conversely, those with an external locus of control are primarily guided by external factors. The impact of professional ethics on the strength of ethical decision-making depends on the consultant’s locus of control. Consultants with internal locus of control show stronger influence of ethical standards on their decisions, while those with external locus exhibit weaker influence as they rely more on external factors. Based on these findings, H4 is supported.

Locus of Control Moderates Tax Consultant Competence on Ethical Decision-Making

The results in Table 5 indicate that locus of control does not moderate the relationship between tax consultant competence and ethical decision-making. In other words, competence influences ethical decision-making independently of locus of control. This finding suggests reconsidering the role of locus of control in this relationship or exploring other potentially more relevant moderating factors. Based on this analysis, H5 is not supported.

Locus of Control Moderates Machiavellianism on Ethical Decision-Making

As shown in Table 5, locus of control does not moderate the relationship between Machiavellianism and ethical decision-making. This means Machiavellian traits affect tax consultants’ ethical decisions regardless of whether individuals have internal or external locus of control. However, locus of control may mitigate the negative effects of Machiavellianism by encouraging individuals to consider personal responsibility for decision outcomes and increasing ethical decision-making tendencies when locus of control is present. Therefore, H6 is not supported.

CONCLUSIONS

This study examines the influence of professional ethics, tax consultant competence, and Machiavellianism on ethical decision-making among tax consultants in Indonesia’s Banten region, with locus of control as a moderating variable. The key findings are as follows:

- Professional ethics significantly affects ethical decision-making. Tax consultants must continually strengthen their understanding and application of professional ethics to maintain ethical decision-making across all situations.

- Tax consultant competence significantly influences ethical decision-making. Developing competencies through training and certification programs is essential to enhance consultants’ ability to make sound ethical decisions

- Machiavellianism significantly impacts ethical decision-making. Organizations should implement measures to minimize this influence by fostering integrity cultures and strengthening ethical oversight in tax consulting practices.

- Locus of control moderates the relationship between professional ethics and ethical decision-making. Developing an internal locus of control helps consultants apply professional ethics more consistently when making ethical decisions.

- Locus of control does not moderate the competence-ethical decision-making relationship. Future research should explore other potential moderating factors that may strengthen this relationship.

- Locus of control does not moderate the Machiavellianism-ethical decision-making relationship. Further investigation is needed to identify factors that could mitigate Machiavellianism’s negative effects on ethical decision-making.

REFERENCE

Alvionita, N., & Aufa, M. (2023). The Influence of Professionalism, Machiavellianism, and Ethical Environment on Whistleblowing with Locus of Control as Moderator. Soedirman Accounting Review (SAR): Journal of Accounting and Business, 08(02), 206–219.

Bell, D. (1976). The Coming of Post-industrial Society. A Venture in Social Forecasting. With a New Introd. by the Author. Basic Books. http://www.amazon.com/The-Coming-Post-Industrial-Society-Forecasting/dp/0465097138

Bhandari, J., Awais, M., Robbins, B. A., & Gupta, V. (2023). Leprosy. StatPearls. https://www.ncbi.nlm.nih.gov/books/NBK559307/

Christian, Y. G., & Susanto, Y. K. (2021). Ethical Decision-Making of Tax Consultants: The Importance of Social Responsibility and Machiavellianism. Indonesian Study of Accounting and Finance, 4(2), 156–177. https://doi.org/10.21632/saki.4.2.156-177

Duhita, S. F., Arief, M., & Widyaningsih, A. (2022). The Application of Locus of Control and Professional Ethics on Auditor Performance. Education and Development Journal, 10(3), 508–515. https://doi.org/10.37081/ED.V10I3.3950

Dwipa, A. A. G. P., Ratnadi, N. M. D., Yadnyana, I. K., & Budhiarta, K. (2023). Ethical Orientation, Situational Factors, and Ethical Decision-Making with Professional Commitment as a Moderator. E-Jurnal Akuntansi, 33(7). https://doi.org/10.24843/EJA.2023.V33.I07.P11

Greenhaus, J., & Callanan, G. (2006). Encyclopedia of Career Development. SAGE Publications, Inc. https://doi.org/10.4135/9781412952675

Jazadi, F. R. (2023). Implementation of Professional Ethics and Locus of Control on Auditor Performance. GANEC SWARA, 17(4), 2109. https://doi.org/10.35327/GARA.V17I4.677

Jiwo, P. (2011). Analysis of Individual Factors in Ethical Decision-Making by Tax Consultants (An Empirical Study of Tax Consultants at Accounting Firms in Semarang) [Universitas Diponegoro]. https://repofeb.undip.ac.id/5702/

Laluhu, S. (2020, July 29). Reduced Sentence for Tax Consultant of Mining Trading Company. Sindo News. https://nasional.sindonews.com/read/117016/13/vonis-konsultan-pajak-perusahaan-trading-tambang-dipangkas-1596010068

Limajatini, L., Murwaningsari, E., & Khomsiyah, K. (2019). Analysis of Effect of Power Distance, Power Avoidance, Individualism, Masculinity and Time Orientation Toward Auditing Behavior with Mediation of Locus of Control. ECo-Fin, 1(1), 12–21. https://doi.org/10.32877/EF.V1I1.53

Made, N., Dwi, A., Dewi, L., & Dwiyanti, K. T. (2018). Factors in Ethical Decision-Making by Tax Consultants: Individual and Situational. Scientific Journal of Accounting and Business, 3(1), 23–35. https://doi.org/10.38043/JIAB.V3I1.2096

Maharani, S. (2024). The Influence of Idealism, Experience, Professional Commitment, and Tax Sanctions on the Ethical Decision-Making of Tax Consultants (A Case Study on Tax Consultants in Palembang City). Universitas Sriwijaya.

Nadilla, I., & Juliardi, D. (2021). The effects of machiavellian, equity sensitivity, and ethical sensitivity on the accounting students’ ethical perceptions in perceiving the accountants’ ethics. Journal of Economics, Business, and Education, 1(2), 172–182. https://doi.org/10.17977/um066v1i22021p172-182

Ng, S., Lukman, L., & Tanzil, W. Y. (2023). The Influence of Machiavellianism, Social Responsibility, and Risk Preference on Ethical Decision-Making of Tax Consultants. Jurnal Cahaya Mandalika ISSN 2721-4796 (Online), 3(2), 303–317. https://doi.org/10.36312/JCM.V3I2.1537

Pratama, A. (2024, April 20). Christian Tjong, Tax Consultant: 7-Year DPO Inactive Until Arrested by Attorney General’s Office. Monitor Indonesia. https://monitorindonesia.com/hukum/read/2024/04/586229/christian-tjong-konsultan-pajak-dpo-7-tahun-tak-berkutik-ditangkap-kejagung

Pratama, I. M. I., & Wirama, D. G. (2018). Locus of Control Moderating the Influence of Intellectual, Emotional, and Spiritual Intelligence on Ethical Decision-Making of Tax Consultants. E-Jurnal Akuntansi, 22(1), 595. https://doi.org/10.24843/EJA.2018.v22.i01.p23

Rotter, J. B. (1966). Generalized expectancies for internal versus external control of reinforcement. Psychological Monographs: General and Applied, 80(1), 1–28. https://doi.org/10.1037/h0092976

Sabaruddin, S., Sulhendri, S., & Septemberizal, S. (2023). Determinants of Ethical Decision-Making by Tax Consultants. Accounting and Governance Journal, 4(1), 38. https://doi.org/10.24853/jago.4.1.38-55

Silitonga, S. E., & Hidayat, N. (2019). The Effect of Ethics & Social Responsibility, Machiavellian Character, and Competency on Ethical Decision-Making of Tax Consultants (Case Study of Tax Consultants in Bandung). South East Asia Journal of Contemporary Business, Economics and Law, 20(5), 1–8.

Sinaga, M. (2022). The Influence of Ethical Code and Role of Tax Consultants on Taxpayer Compliance at Muhammad Rafiqi Tax Consultant Office. Universitas Medan Area.

Sundari, R., Juwita, R., Casmadi, Y., & Syafrizal, A. (2021). The Influence of Professional Ethics and Competence on Ethical Decision-Making of Tax Consultants in Surabaya. Ekspansi: Journal of Economics, Finance, Banking, and Accounting, 13(1), 1–14. https://doi.org/10.35313/ekspansi.v13i1.2330

Tofiq, T. A., & Mulyani, S. D. (2018). Analysis of the Influence of Machiavellian Traits, Ethics, Social Responsibility, Situational Factors, and Locus of Control on Ethical Decision-Making by Tax Consultants. SCIENTIFIC JOURNAL OF REFLECTION: Economic, Accounting, Management and Business, 1(4), 91–100. https://doi.org/10.5281/zenodo.1437014

Utama, I. G. Y. S., & Jati, I. K. (2024). Moderating Effect of Locus of Control on the Influence of Idealism and Professional Commitment Toward Ethical Decision-Making of Tax Consultants. E-Journal of Economics and Business, Udayana University, 77. https://doi.org/10.24843/EEB.2024.v13.i01.p07.

Penulis adalah anggota IKPI Cabang Kota Tangerang

Ratri Widiyanti

Email: ratriwidiyanti@gmail.com

Suhendra

Email: suhendra.suhendra@ubd.ac.id

Korespondensi: Universitas Buddhi Dharma